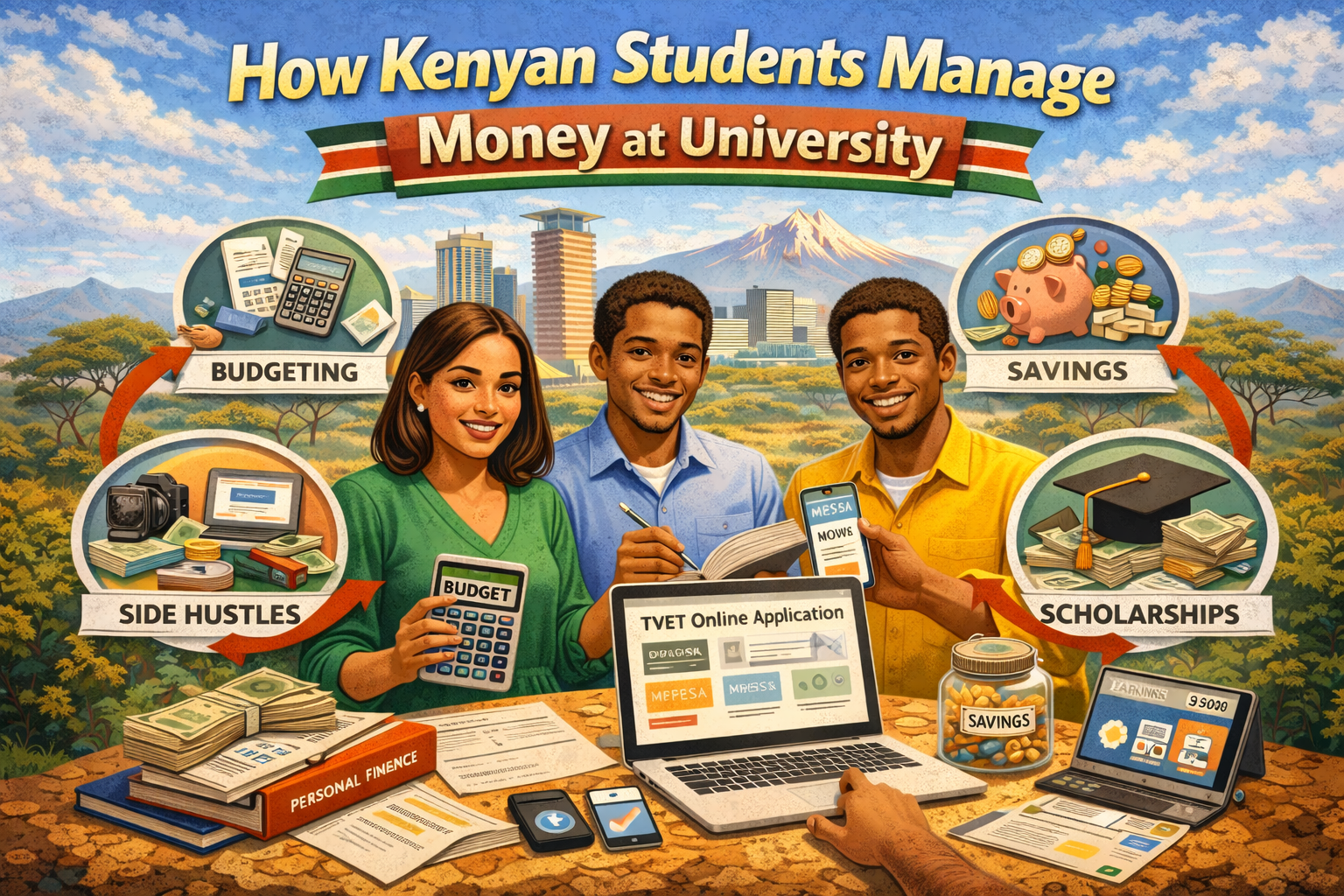

Understanding the daily spending habits of Kenyan university students reveals patterns that separate those who manage money well from those who constantly run broke. What students spend money on each day might seem insignificant, but these small choices accumulate into the difference between financial stability and stress by mid-semester.

Most students don’t realize that daily habits, not monthly expenses, determine whether their upkeep money lasts. A Ksh 100 purchase repeated daily becomes Ksh 3,000 monthly—enough to buy several days’ worth of groceries or cover transport for a week.

This guide explores real spending patterns, identifies where money actually goes, and helps students make better financial decisions without sacrificing reasonable enjoyment of campus life.

How a Typical Student’s Day Looks Financially

Let’s walk through what student spending patterns Kenya look like during an ordinary campus day.

Morning Spending (6:00 AM – 10:00 AM)

The day begins with breakfast decisions that significantly impact daily budgets. Students who wake up early and prepare tea or porridge at home spend almost nothing—maybe Ksh 10 to Ksh 20 on ingredients.

However, many students skip cooking and buy breakfast from vendors near campus. A mandazi or chapati with tea costs Ksh 50 to Ksh 100. Some students grab more substantial meals like sausages, eggs, or samosas, spending Ksh 100 to Ksh 150 on breakfast alone.

Transport to campus for students living off-campus costs Ksh 30 to Ksh 100 each way depending on distance. Students making this trip daily spend Ksh 60 to Ksh 200 just getting to and from classes.

By 10:00 AM, a student who bought breakfast and took matatus has already spent Ksh 120 to Ksh 300, and classes have barely started.

Mid-Morning Spending (10:00 AM – 1:00 PM)

Between classes, students often buy snacks or drinks. Campus vendors sell roasted maize, boiled eggs, sweets, biscuits, and soft drinks. A mid-morning snack costs Ksh 20 to Ksh 100.

Internet bundles get purchased when students need to submit assignments or research something urgently. Daily bundles cost Ksh 20 to Ksh 50.

Printing and photocopying assignments happens throughout the day. Students spend Ksh 20 to Ksh 200 depending on how many pages they need printed or how many handouts they’re photocopying.

By lunchtime, another Ksh 50 to Ksh 200 has disappeared from the student’s wallet.

Lunch Spending (1:00 PM – 3:00 PM)

Lunch represents one of the largest daily expenses. Campus cafeterias charge Ksh 100 to Ksh 200 for basic meals like rice or ugali with vegetables and a small piece of meat or beans.

Students eating at nearby restaurants spend Ksh 150 to Ksh 300 for more variety or larger portions. Popular student hangouts near universities offer meals ranging from Ksh 200 to Ksh 500 depending on what you order.

Students who packed lunch from home spend nothing during this period, having already used ingredients costing Ksh 50 to Ksh 100 when preparing food earlier.

The difference between cooking and eating out reveals itself starkly at lunch: Ksh 50 versus Ksh 150-300 per meal.

Afternoon Spending (3:00 PM – 6:00 PM)

Afternoon spending includes additional snacks, drinks, or coffee for students spending time in study groups or libraries. Student cafes charge Ksh 100 to Ksh 200 for coffee and snacks.

Students working on group projects often contribute money for materials, printing, or binding reports. These contributions range from Ksh 50 to Ksh 500 depending on project requirements.

Some students attend afternoon classes requiring transport to different campuses or field locations, adding Ksh 50 to Ksh 200 to daily transport costs.

Social spending begins in the afternoon when friends suggest grabbing snacks or drinks together. Students find it hard to refuse these invitations, spending Ksh 100 to Ksh 300 on unplanned social activities.

Evening Spending (6:00 PM – 10:00 PM)

Evening hours show the widest variation in spending patterns. Budget-conscious students head home or to hostels, prepare dinner, and spend minimal amounts.

Other students eat dinner out, spending Ksh 150 to Ksh 400 at cafeterias or restaurants. Some days involve special occasions—birthdays, celebrations, or just friends wanting to hang out—pushing evening spending to Ksh 500 to Ksh 2,000.

Weekend evenings, especially Friday and Saturday, see dramatically higher spending. Students going to clubs, movies, or entertainment venues easily spend Ksh 1,000 to Ksh 3,000 in a single evening on entrance fees, drinks, transport, and food.

Transport home after evening classes or activities costs another Ksh 30 to Ksh 100 for students living off-campus.

Daily Spending Totals

A typical weekday for a budget-conscious student who cooks most meals totals Ksh 150 to Ksh 300 daily, mostly on transport and occasional small purchases.

An average student buying lunch and snacks on campus spends Ksh 400 to Ksh 700 daily during weekdays.

Students eating all meals out and socializing regularly spend Ksh 800 to Ksh 1,500 or more daily.

These daily patterns multiplied across 30 days explain why some students manage on Ksh 10,000 monthly while others need Ksh 25,000 or more.

Common Student Expenses Campus: The Regular Purchases

Understanding common student expenses campus helps identify where money actually goes beyond obvious categories.

Food and Beverage Purchases

Food dominates daily spending. Beyond main meals, students constantly buy snacks, drinks, fruits, and sweets throughout the day. These small purchases feel insignificant individually but accumulate significantly.

Bottled water costs Ksh 30 to Ksh 50 each time you buy it. Students purchasing water daily instead of carrying refillable bottles spend Ksh 900 to Ksh 1,500 monthly on something that could cost almost nothing.

Soft drinks cost Ksh 50 to Ksh 150 depending on size and brand. Students buying one soda daily spend Ksh 1,500 to Ksh 4,500 monthly—enough to buy a week’s groceries.

Coffee culture has become popular at universities. Students meeting at cafes spend Ksh 150 to Ksh 300 per visit on coffee and snacks. Frequent cafe-goers spend thousands monthly on beverages that provide minimal nutritional value.

Transport Expenses

Transport costs add up quickly for students living off-campus. Even short matatu rides cost Ksh 30 to Ksh 50 each way. Making two trips daily (to campus and back) costs Ksh 1,800 to Ksh 3,000 monthly.

Students using boda bodas for convenience spend Ksh 50 to Ksh 200 per trip. This convenience costs significantly more than matatus but saves time and provides door-to-door service.

Ride-hailing services like Uber or Bolt cost even more—Ksh 150 to Ksh 500 for trips that matatus cover for Ksh 30 to Ksh 50. Students using these services frequently spend double or triple what budget-conscious peers spend on transport.

Weekend travel home for students who go every week adds Ksh 500 to Ksh 2,000 weekly to transport budgets, totaling Ksh 2,000 to Ksh 8,000 monthly.

Academic-Related Purchases

Daily academic expenses include printing assignments, buying stationery, photocopying notes, and purchasing internet bundles for research and communication.

Printing costs Ksh 5 to Ksh 10 per page depending on whether it’s black and white or color. Students printing assignments regularly spend Ksh 300 to Ksh 800 monthly.

Photocopying lecture notes or reading materials costs Ksh 2 to Ksh 5 per page. Depending on courses, students photocopy hundreds of pages per semester, spending Ksh 500 to Ksh 2,000 monthly.

Internet bundles for students without reliable campus Wi-Fi access cost Ksh 500 to Ksh 2,000 monthly depending on data needs.

Pens, notebooks, folders, and other stationery require Ksh 200 to Ksh 500 monthly for most students.

Personal Care Daily Purchases

Personal grooming requires regular small purchases. Haircuts cost Ksh 100 to Ksh 500 depending on gender and styling preferences. Many male students get haircuts every two to three weeks, spending Ksh 400 to Ksh 1,000 monthly.

Toiletries need regular replenishment. Soap, toothpaste, tissue, and other basics cost Ksh 1,000 to Ksh 2,000 monthly.

Laundry expenses for students who don’t wash their own clothes range from Ksh 300 to Ksh 800 monthly depending on volume and location.

Social and Entertainment Spending

Social expenses vary wildly between students. Contributing to friends’ birthdays, chipping in for group outings, or treating someone costs Ksh 100 to Ksh 1,000 per occasion.

Campus events like club nights, concerts, or special performances charge Ksh 200 to Ksh 1,500 for entry. Students attending multiple events monthly spend thousands on entertainment alone.

Phone and Airtime

Most students spend Ksh 20 to Ksh 100 daily on airtime or mobile money transactions. This seemingly small amount totals Ksh 600 to Ksh 3,000 monthly.

Mobile money transaction fees add up when students frequently send or receive money, pay for items via M-PESA, or withdraw cash from agents.

Where Students Spend Most Money: The Top Categories

Analyzing where students spend most money reveals surprising patterns that explain financial struggles.

Food Takes the Crown

Across all spending categories, food consistently consumes the largest portion of student budgets. Whether cooking or eating out, food requires Ksh 5,000 to Ksh 15,000 monthly depending on choices made.

The problem isn’t that food is expensive—it’s that students make expensive food choices. Eating out for every meal when cooking costs half as much represents a choice that dramatically increases spending.

Additionally, snack culture drains money. Students constantly buying snacks, drinks, and fast food between meals spend thousands monthly on food that provides minimal nutritional value while leaving them hungry enough to buy more food later.

Transport Comes Second

For students living off-campus, transport ranks as the second-largest expense category. Daily commuting, weekend trips home, and occasional travel for events or emergencies cost Ksh 2,000 to Ksh 8,000 monthly.

Students choosing expensive transport options like ride-hailing services or boda bodas instead of matatus multiply their transport costs unnecessarily.

Social Life Drains Resources

Lifestyle spending university Kenya on social activities surprises students who don’t track these expenses. Going out with friends, attending events, contributing to celebrations, and maintaining social appearances costs Ksh 2,000 to Ksh 8,000 monthly for socially active students.

What makes social spending dangerous is its unpredictability and the peer pressure involved. Declining invitations feels awkward, so students spend money they hadn’t planned to use, disrupting their entire budget.

Technology and Communication

Phone expenses including airtime, data bundles, and mobile money transactions cost Ksh 1,000 to Ksh 3,000 monthly for most students.

While necessary for communication and academic work, many students buy more data than they actually use or make unnecessary calls that increase expenses.

Accommodation Stays Stable

Interestingly, accommodation—despite being a large expense—rarely varies month to month. Once rent is set, it remains constant. The financial struggles students face come primarily from variable daily expenses, not fixed monthly costs.

Lifestyle Spending University Kenya: Different Student Profiles

Looking at lifestyle spending university Kenya reveals distinct student spending profiles.

The Budget-Conscious Student

These students typically spend Ksh 300 to Ksh 500 daily during weekdays. They cook most meals, walk or use affordable transport, bring water from home, and rarely eat out unless necessary.

Their monthly spending stays around Ksh 10,000 to Ksh 13,000. They achieve this through consistent discipline, tracking expenses, and prioritizing needs over wants.

The Average Student

Most students fall into this category, spending Ksh 500 to Ksh 800 daily. They cook some meals but eat out regularly, take matatus for transport, buy occasional snacks and drinks, and socialize moderately.

Their monthly spending ranges from Ksh 15,000 to Ksh 20,000. They manage reasonably well but sometimes face financial pressure during expensive weeks.

The Social Butterfly

Highly social students spend Ksh 800 to Ksh 1,500 daily. They eat out frequently, attend many events, maintain active social lives, and prioritize experiences and relationships.

Their monthly spending reaches Ksh 20,000 to Ksh 30,000 or more. They often struggle financially unless their families can afford these amounts comfortably.

The Struggling Student

Some students want to live like social butterflies but lack the financial resources. They spend heavily on social activities and appearances, going into debt or constantly calling home for emergency funds.

Their actual spending might only be Ksh 15,000 monthly, but they try to maintain lifestyles requiring Ksh 25,000, creating constant financial stress.

The Hustler

These students supplement family support with income from side jobs. They might spend Ksh 600 to Ksh 1,000 daily but earn Ksh 5,000 to Ksh 10,000 monthly through tutoring, freelancing, or small businesses.

Their total monthly spending reaches Ksh 18,000 to Ksh 25,000, but they only need Ksh 12,000 to Ksh 15,000 from home because they generate the rest themselves.

Hidden Spending Patterns Students Don’t Notice

Several spending patterns drain money without students realizing what’s happening.

The Small Purchase Trap

Students underestimate how Ksh 50 here and Ksh 100 there accumulate. Buying a snack, a drink, airtime, and a small item throughout the day feels harmless. But five Ksh 100 purchases daily equal Ksh 15,000 monthly—more than many students’ entire food budgets.

The Convenience Premium

Students pay extra for convenience without calculating the cost. Buying water instead of carrying a bottle, taking boda bodas instead of matatus, or eating out instead of cooking all cost more for the sake of convenience.

The Social Spending Avalanche

Accepting every social invitation creates spending avalanches. One friend suggests lunch (Ksh 300), another wants coffee (Ksh 200), someone’s birthday requires a contribution (Ksh 500), and by week’s end, you’ve spent Ksh 3,000 to Ksh 5,000 unplanned.

The Weekend Spending Surge

Students who budget well Monday through Friday often lose control on weekends. Friday and Saturday spending can equal or exceed entire week’s expenses, destroying carefully managed budgets.

The Idle Time Spending

Boredom leads to spending. Students with free time wander around campus buying snacks, window shopping that turns into actual shopping, or suggesting activities that cost money simply because they have nothing else to do.

How Successful Students Manage Daily Spending

Students who successfully manage daily spending follow specific strategies that prevent money from disappearing mysteriously.

They track everything: Writing down or recording every expense creates awareness. Knowing where money goes makes it easier to identify and eliminate wasteful patterns.

They prepare in advance: Cooking meals ahead, packing snacks, filling water bottles, and planning transport routes saves money daily.

They set daily spending limits: Deciding to spend no more than Ksh 200, Ksh 300, or Ksh 500 daily provides guardrails that prevent overspending.

They delay purchases: Waiting 24 hours before buying non-essential items eliminates impulse purchases. Many things that seem necessary in the moment become irrelevant by the next day.

They find free alternatives: Using campus Wi-Fi instead of buying bundles, drinking tap water instead of buying bottled water, and using campus facilities instead of paying for external services reduces expenses dramatically.

They batch purchases: Shopping once weekly for groceries instead of daily trips to shops prevents small purchases that accumulate and reduces temptation to buy unnecessary items.

They socialize affordably: Suggesting free or cheap activities when friends want to hang out maintains social connections without overspending.

They say no gracefully: Learning to decline expensive invitations without damaging friendships protects budgets from social pressure.

Frequently Asked Questions

How much should a university student spend daily in Kenya?

Budget-conscious students can manage well on Ksh 200 to Ksh 400 daily by cooking meals, using affordable transport, and avoiding unnecessary purchases. Average students spend Ksh 500 to Ksh 700 daily. Spending more than Ksh 1,000 daily requires either substantial family support or personal income, as this totals Ksh 30,000 monthly.

What’s the biggest money mistake students make daily?

Buying food and drinks constantly instead of preparing meals in advance. Students spend Ksh 500 to Ksh 1,000 daily on meals and snacks that could cost Ksh 150 to Ksh 300 if prepared at home. This single habit creates the difference between managing comfortably and constant financial stress.

How can I stop spending money on small things throughout the day?

Carry snacks and water from home to avoid buying them on campus. Set a daily spending limit and track every purchase. Leave excess cash and cards at home, carrying only what you absolutely need. Find free activities during idle time instead of wandering around shops and vendors.

Should students eat all meals at the cafeteria or cook?

Cooking saves substantially more money—roughly half what eating out costs. However, cooking all three meals daily requires time and energy. A practical compromise is cooking breakfast and dinner while buying lunch on campus, balancing convenience with affordability.

How much do social activities really cost students monthly?

Highly social students spend Ksh 5,000 to Ksh 10,000 monthly on entertainment, eating out with friends, and social events. Moderate socializing costs Ksh 2,000 to Ksh 3,000 monthly. Students focusing primarily on studies with occasional social activities spend Ksh 500 to Ksh 1,000 monthly. The difference reflects lifestyle choices, not campus requirements.

What spending habits separate successful students from struggling ones?

Successful students cook most meals, track expenses daily, prioritize needs over wants, prepare in advance, and say no to expensive social pressure. Struggling students eat out constantly, make impulsive purchases, don’t track spending, and try maintaining appearances beyond their financial capacity. The difference is habits and choices, not necessarily income levels.

Conclusion

The daily spending habits of Kenyan university students reveal that financial success or struggle comes down to small decisions repeated consistently. Students who manage Ksh 10,000 monthly comfortably and those who struggle despite receiving Ksh 25,000 differ primarily in their daily choices, not their circumstances.

Understanding student spending patterns Kenya shows that food, transport, and social activities consume the most money. However, where students spend most money often reflects choices rather than necessities. Cooking versus eating out, walking versus taking taxis, and free versus paid entertainment create thousands of shillings difference monthly.

The common student expenses campus are manageable when approached consciously. A Ksh 100 purchase seems harmless, but repeated daily becomes Ksh 3,000 monthly. Five such habits simultaneously equal Ksh 15,000 monthly—more than many students’ entire budgets.

Lifestyle spending university Kenya varies dramatically between student profiles. Budget-conscious students, average students, social butterflies, and hustlers all attend the same universities but spend vastly different amounts based on priorities and habits.

The key to financial success at university isn’t having more money—it’s developing better spending habits. Track your expenses for one week honestly, and you’ll discover exactly where your money goes. Most students find they’re spending thousands monthly on things they didn’t even realize they were buying.

Start by addressing your biggest expense categories. If food drains most money, learn to cook. If transport costs too much, consider living closer to campus. If social spending creates stress, find free or affordable ways to connect with friends.

Remember that your daily habits today shape your financial future. The discipline you develop managing Ksh 500 daily at university will serve you when managing Ksh 5,000 daily in your career. Make these years an opportunity to build habits that lead to lifelong financial stability rather than struggle.

Campus life offers incredible experiences, learning opportunities, and friendships that last forever. Enjoy these years fully, but do so in ways that don’t create unnecessary financial stress or debt. Smart daily spending habits let you focus on what truly matters—your education, personal growth, and building a foundation for successful life ahead.

Leave a Comment